LHR’s Responsible Investment Policy formalizes our approach to responsible investment – increasing transparency between LHR, its portfolio companies and investors.

We believe weak ESG systems lead to greater uncertainty and added exposure to potential liabilities, but more importantly, that ethical investing is morally correct and encourages mining firms to improve their behavior.

Our commitment to ESG is formalized in our investment process, Investment Committee and Board policies and in the longer-term operations and reporting of our portfolio companies. Through Board and Committee representation, direct ownership and/or voting controls, we commonly retain the ability to influence the incorporation of our ESG principles across the life of the asset. Lionhead Resources is a signatory to the UN PRI, and has integrated those principles into our investment process and policy.

Where we are reasonably able to, we seek to assess and report on key ESG factors, both at initial acquisition and throughout the asset lifecycle to determine.

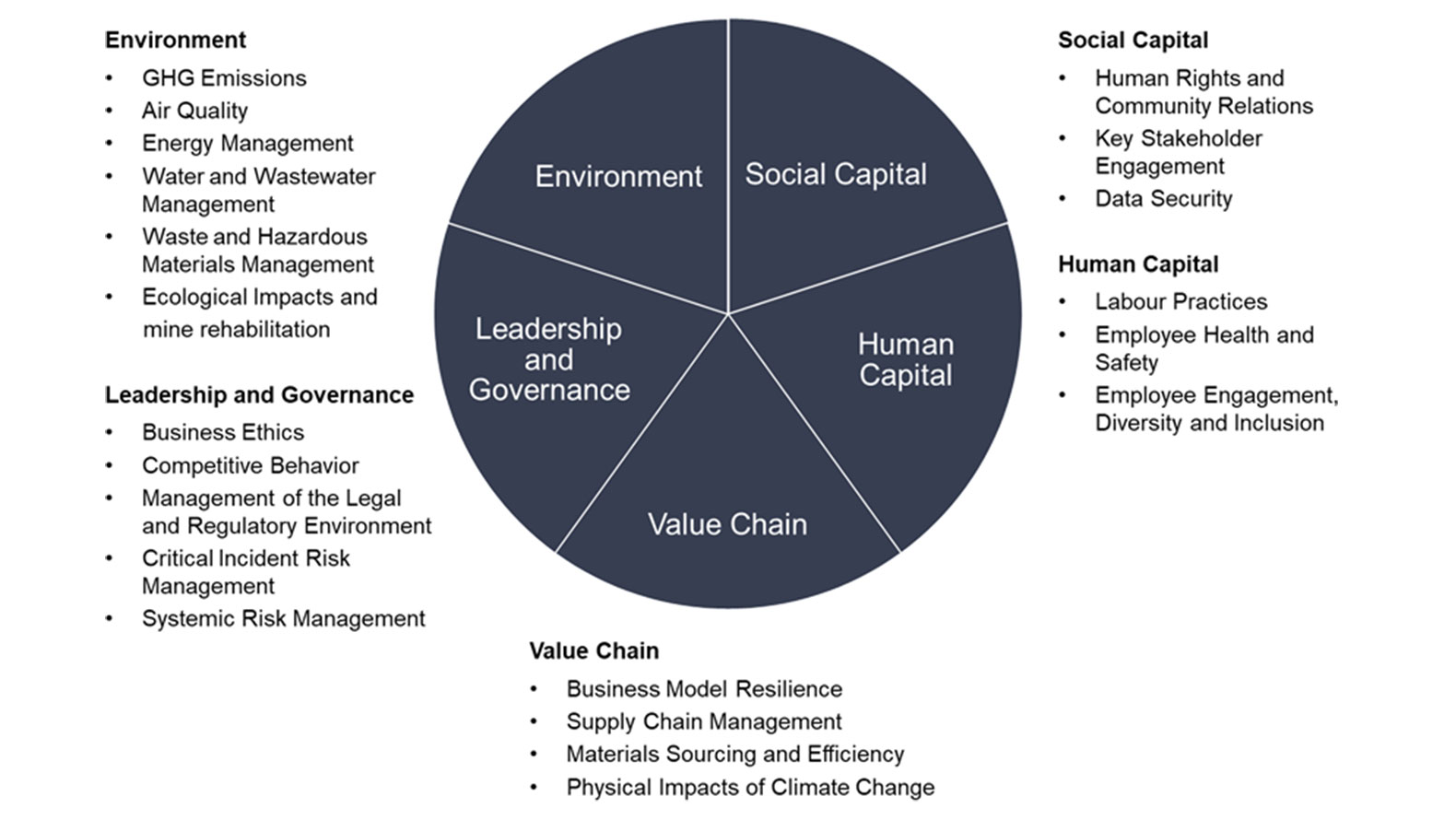

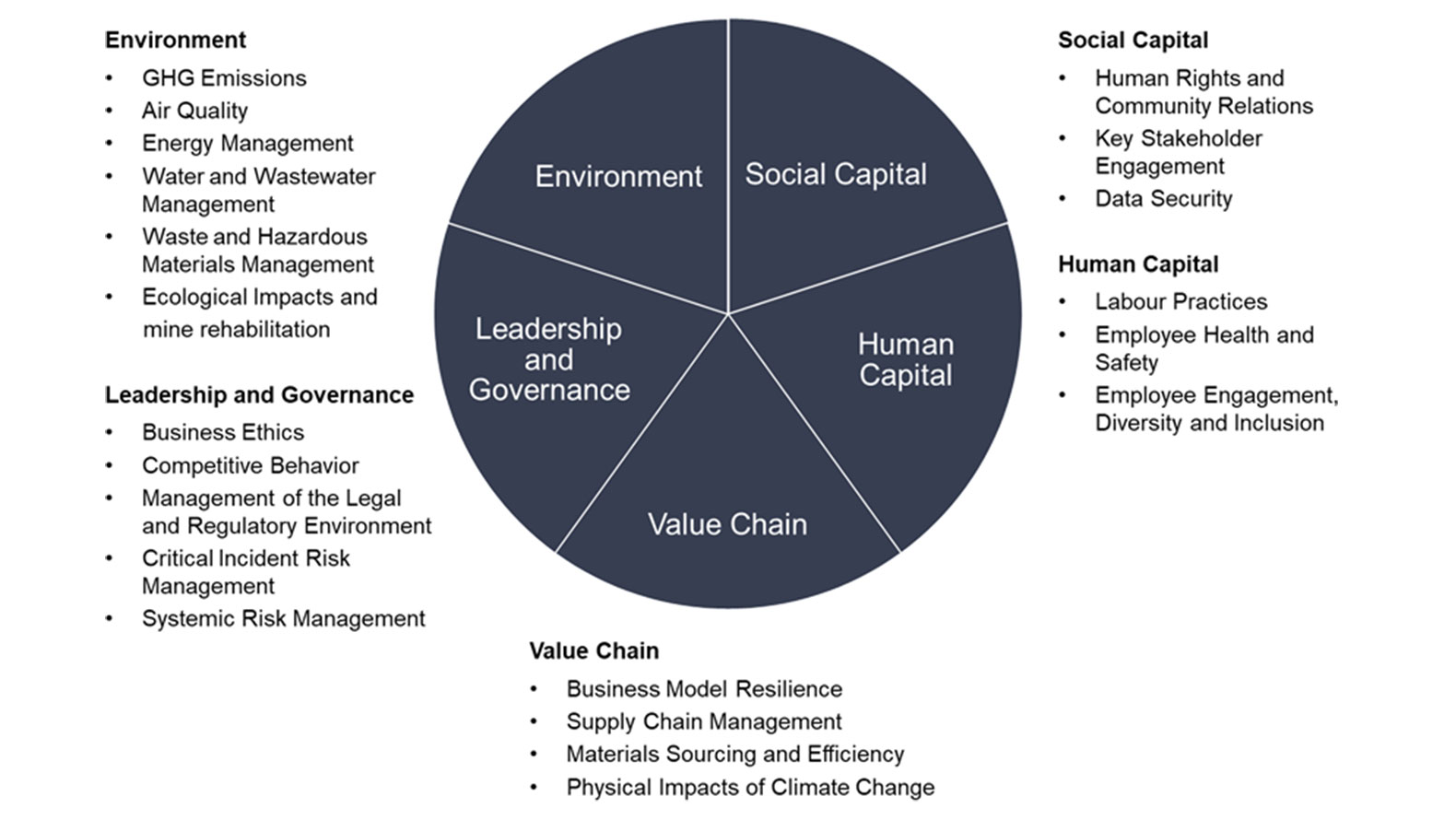

Holistic Approach to Considering ESG

Our commitment to being a responsible investor that adheres to defined ESG principles is an ongoing process where we continuously seek to improve and refine our procedures, reporting and verification/qualification of impacts.

We engage with stakeholders on the enhancement of our ESG Policy, and seek their feedback on ESG issues relevant to LHR and the investment mandates we hold from time to time.

LHR will disclose ESG performance by reporting at least annually to our investors on our ESG performance and progress and our success or otherwise in the management of material risks and opportunities.